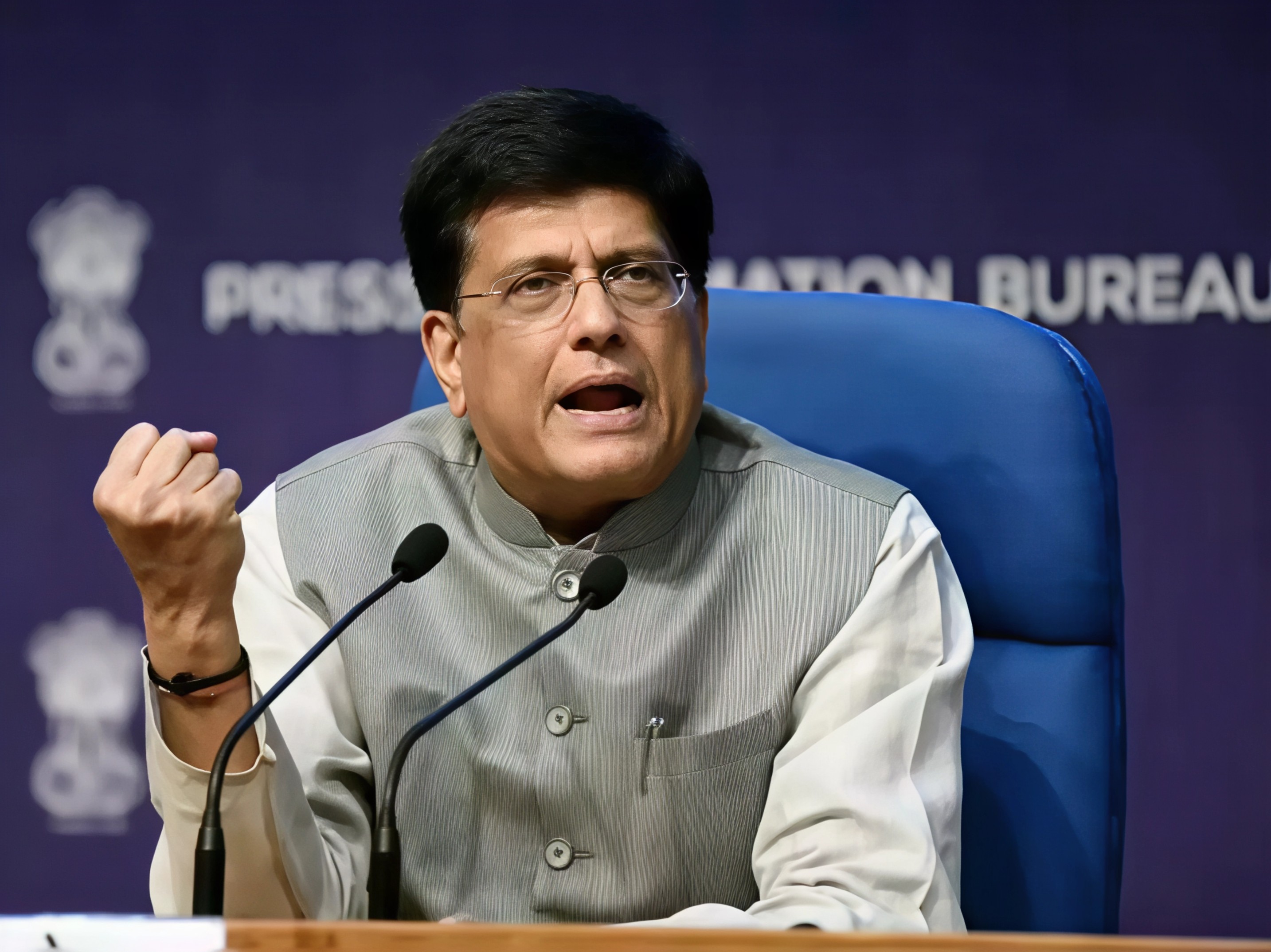

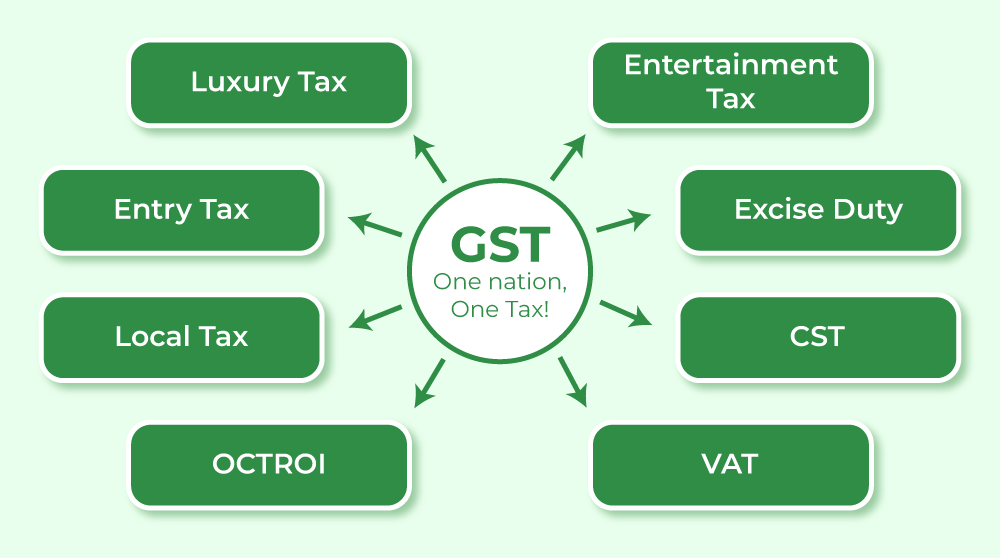

Travel in India just got a little friendlier on the wallet. The government’s new Goods and Services Tax (GST) rates, effective September 22, are bringing relief to millions of travellers by lowering the cost of flights, hotels, and dining. For the first time since GST was introduced in 2017, the tourism and hospitality sector is seeing sweeping reforms that promise to reshape how people plan their trips.

Air Travel Becomes More Accessible

One of the most significant changes is in airfares. Economy flight tickets now carry just 5 percent GST instead of 12 percent, while business class fares have been reduced from 18 percent to 12 percent. This reform is expected to directly reduce ticket prices, particularly during festive and wedding seasons when families often travel together.

Industry experts note that while luxury travellers may not notice the change, regular flyers stand to benefit the most. For the growing middle class, lower ticket prices could mean more frequent trips, making air travel more accessible than ever before. Even private jets and charter flights have seen reductions, though this largely impacts a niche market.

Hotels See Major Relief for Mid-Range Travellers

Hotels are where the reforms will be most visible. Rooms priced under ₹1,000 remain exempt from GST, but the real breakthrough is for mid-range accommodation. Rooms priced between ₹1,000 and ₹7,500 will now attract only 5 percent GST compared to the earlier 12 to 18 percent range. Luxury hotels above ₹7,500 remain at 18 percent.

For a family staying in a ₹7,000 per night hotel for three nights, the savings are substantial—about ₹1,500 less in GST charges compared to before. This makes extended stays more affordable for domestic tourists and also strengthens India’s appeal to international travellers comparing prices with other Asian destinations. Experts say this move puts India more in line with global trends and gives a strong push to inbound tourism.

Dining Out Gets Friendlier on the Budget

Eating out has also become cheaper. A uniform GST rate of 5 percent now applies to standalone restaurants and hotel dining outlets outside of luxury properties. Previously, rates were as high as 18 percent, making meals significantly more expensive.

For diners, the reduction means more value for money. For restaurants, it simplifies compliance and improves margins, creating a healthier business environment. While alcohol remains outside the GST structure and continues under state taxes, the reform still offers a major boost to the food and beverage sector.

Impact on Tour Packages and the Bigger Picture

Tour packages that combine hotels, transport, and activities remain a grey area. While cheaper hotel rates do provide some benefit, limited provisions for input tax credit still complicate matters for operators. Industry leaders are urging the government to reconsider policies to allow more seamless savings across bundled packages.

However, analysts agree that the focus on mid-market affordability is a smart move. Budget-conscious travellers and families stand to gain the most, while premium hotels and luxury travellers remain largely unaffected. The changes also simplify compliance, reducing stress for small and mid-sized hotels and restaurants.

A New Chapter for Travel in India

These reforms are more than just tax adjustments—they represent a shift toward making India a more accessible and competitive travel destination. Lower costs for flights, stays, and dining mean travellers can stretch their budgets further, perhaps adding an extra night to their holiday, booking a better hotel, or enjoying a few more meals by the beach.

For domestic travellers, this could be the push needed to explore more of their own country. For international tourists, India now offers more competitive prices compared to Southeast Asia, making it an attractive option for global travellers.

Follow Tech Moves on Instagram and Facebook for more updates on travel, technology, and the trends shaping the future of tourism.